Pace Layers: Tech Platforms, Regulation, and Finite Time Singularities

Click HERE to SIGN UP for SITALWeek’s Sunday EMAIL (please note some ad blocking software may disrupt the signup form; if you have any issues or questions please email sitalweek@nzscapital.com)

For most of the past decade a handful of “platform” stocks, e.g., Facebook, Apple, Amazon and Google, have driven outsized performance in many portfolios. While these companies continue to have resilient and growing free cash flow businesses, their ability to stack new growth curves is likely coming to an end. Throughout the course of history, the positive feedback loop from innovation eventually clashes with the negative feedback loop of governance.

We often use ‘mental models’ as tools to view events in the world. One that we’ve found helpful through the years is Stewart Brand’s Pace Layering model. Like many great mental models, it’s so simple one can sketch it on a napkin, but robust enough for broad application. Here’s the concept:

Imagine these layers are gears – with the gears closer to the outer layer turning more quickly, and the gears nearer to the core turning more slowly. We can imagine the ‘Fashion’ layer changing rapidly while the ‘Nature’ layer moves at a glacial pace: innovation moves quickly at the edge, while geology moves very slowly in the core.

Technology has impacted the cycle speeds and relative gear ratios quite a bit over the past few decades as information and innovation have burrowed into deeper layers. While some investors may view tech as restricted to the less fundamental outer layers (Fashion/Commerce), that perspective underestimates the transformational nature of the Information Age. Most of us realize that many tech companies have moved into the Infrastructure layer. Great examples of this trend are the quintessential platform companies, which are particularly pronounced in the Internet space. While Amazon might have started in the outer layer of innovation, it quickly moved into the Commerce layer and then, with the addition of Amazon Web Services, found itself in the Infrastructure layer. While Google might have developed as a superior search algorithm, it capitalized on that innovation to become an integral part of people’s lives through maps, YouTube, email, etc., thus entering the Commerce/Infrastructure layers.

What’s different about today’s technology companies moving into infrastructure is the speed with which it is happening. The velocity of information transfer has increased exponentially over the course of human history – from tribe-to-tribe verbal communication, to books, to radio, to TV, to the Internet, to smartphones – and has taken ‘constructive turbulence’ and turned it into a destabilizing force because the slower ‘core’ layers simply cannot keep pace with changes in the more superficial layers.

Technology is now like a high speed blender dropping down through all of these layers, from Fashion to Infrastructure to Governance to Culture, and is now so powerful it’s reaching down into Nature – bringing more rapid changes to the planet, re-writing the DNA of the human species with technologies like CRISPR, and changing the way we think with potential direct neural links. Like a tornado, technology is churning up layers and mixing things up that were previously separated.

‘Culture’ is defined as the religious, philosophical, and behavioral norms that have (at least traditionally) been stable for thousands of years. Historically, we would expect fashion or technology to have slow and small impacts on thousand-year-old institutions of Culture, but recently the increased velocity and transparency of information flow is causing rapid behavioral shifts in humans. Information velocity has in some cases caused rising empathy and open mindedness, but in others increased nationalism, fear, and intolerance. Some deeply held beliefs of society have been turned on their head in the last few decades.

We first put the Pace Layers model on the whiteboard over three years ago with an eye toward understanding the meteoric rise and future prospects of the big Internet and technology platforms. While these platforms have been burrowing into the Infrastructure and Culture layers, Governance seems to have been caught napping. Only recently has Governance appeared to be waking up to the disruptive effect of the technological revolution on every sector within the economy (Fashion/Commerce/Infrastructure/Culture, and even Nature with global warming). With respect to the big internet platforms, we believe regulation will be the dominant conversation for years to come as Governance tries to restore order.

One particularly hazardous fallout from the technological revolution is the viral ability to disseminate distorted information. Regulating the massive implications to personal privacy that accompanied the ‘digitization of everything’ will be another colossal challenge. Indeed, playing catch up with these monumental problems is proving so overwhelming that Governance seems to have been seized with a kind of paralysis. As a result, we can expect to see significant negative feedback on the heretofore relatively unchecked technological proliferation and growth of the big platforms. For example, recently the US Congress moved to halt Facebook from developing a new, transactional, blockchain-based currency until such time as government officials and regulatory bodies could even begin to understand the underlying technology and its ramifications. It’s interesting to contrast Governance in the West vs. China, who has, in sharp contrast, paved the way for giant Internet monopolies to innovate and leverage the Internet to create new digital platforms – like Tencent’s WeChat and Alibaba’s Ant Financial. This fundamental difference in Governance philosophy between China and the West has allowed Chinese innovation to run faster with less turbulence.

In the face of increased regulation in the West, tech platforms are more likely to face legislative roadblocks and a shrinking number of adjacent business opportunities to drive growth. Microsoft’s Internet Explorer incident offers a cautionary tale of what might be in store: the consent decree the company received as a punishment for bundling Internet Explorer with the Windows operating system was likely a significant contributing factor to their sideline role during the smartphone and mobile app revolution. Microsoft has rebounded under the dynamic leadership of Satya Nadella by helping their customers shift expensive, on-premises systems to the cloud, but there was an extended lost decade of innovation at Microsoft.

The unprecedented technological disruption pervading all aspects of the economy, human culture, and the planet – combined with the unknowns of coming governmental regulation in the West – is rapidly widening the range of outcomes for many industries around the globe. In other words, predicting the future, which is difficult to begin with in a complex adaptive system, is becoming even harder. One of the key attributes of our Complexity Investing framework is that we specifically try to avoid narrow predictions about how the world might or might not play out. Instead we emphasize companies that are adaptable, with cultures built around long-term thinking, innovation, and maximizing non-zero-sum (NZS), or win-win, outcomes for all of their constituents. Many companies are going to increasingly find themselves caught up in turbulence from these clashing layers over the coming decades, and they will need to quickly adapt and experiment to survive.

Finite Time Singularities and the need for breakthrough innovation

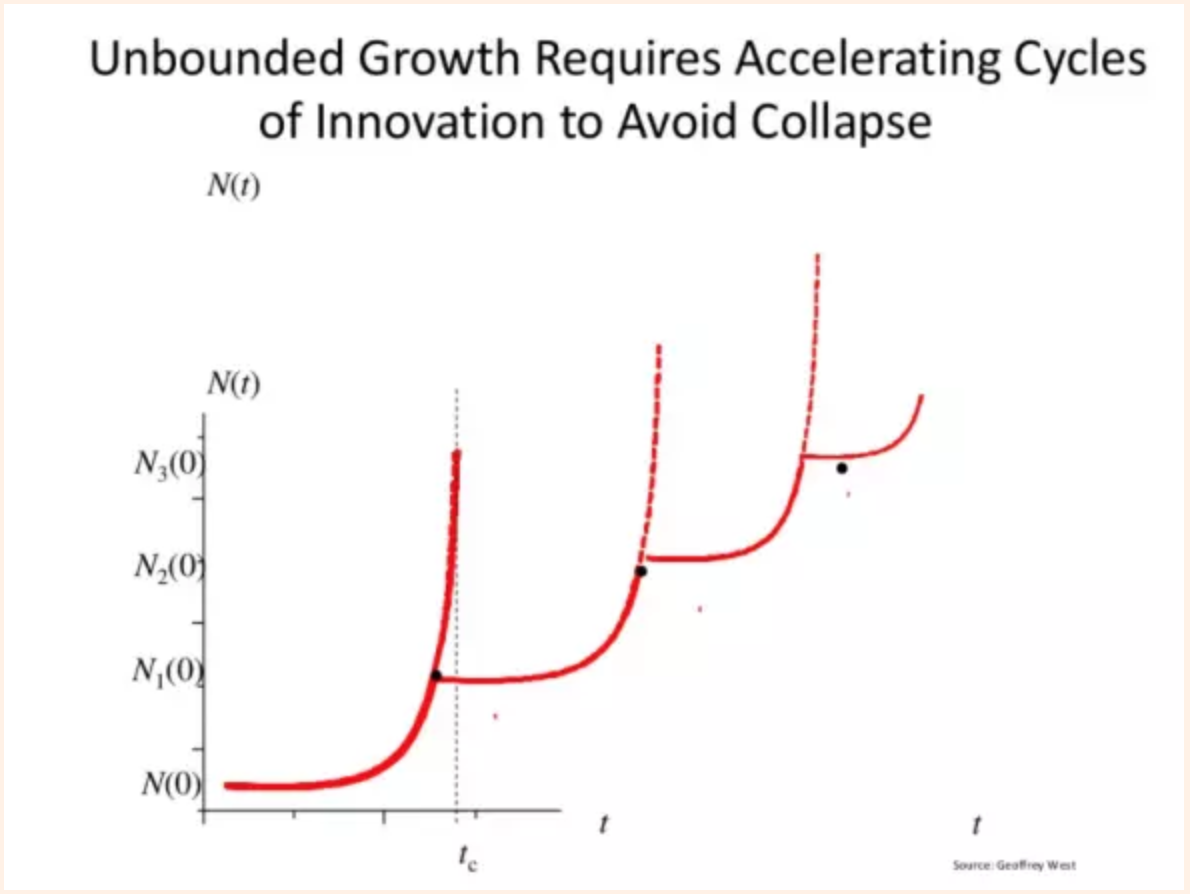

In his book, Scale, theoretical physicist and former Sante Fe Institute president Geoffrey West uses the math of finite time singularities to illustrate the nature and increasing pace of change.

"A finite time singularity simply means that the mathematical solution to the growth equation governing whatever is being considered—the population, the GDP, the number of patents, et cetera—becomes infinitely large at some finite time. This is obviously impossible, and that’s why something has to change."

(Excerpted from P. 417 Scale by Geoffrey West)

In order to reach a new cycle of innovation in West’s model above (and thus avoid collapse), you need a paradigm or phase shift to usher in a new wave of growth and productivity. Platform companies are capable of creating sustained innovation. Bell Labs brought the world semiconductors and information theory in the late 40’s – the two enablers of what has become the digital age. This is a critical point: without the pure science being done at what was the tech platform company of its day, AT&T, there would be no Information Age. Platforms can become crucial enablers of innovation (but they can stifle innovation to preserve their platform).

If Facebook had introduced Libra five years ago, it’s likely they would have faced minimal pushback. Today that’s a much different story. With the new era of increasing governmental scrutiny and regulation, we believe it will become increasingly difficult for platform companies in the West to stack new S-curves on top of their existing businesses, thus slowing growth rates.

Conclusion:

The pace of change is accelerating. Governance has finally woken up to the power of platforms, making it unlikely the large internet platforms will be allowed to continue to stack new S-curves to their existing businesses. Regulation now must also be considered in a global context, not just a country-by-country basis, as artificial intelligence and digital platforms become the new battleground technologies for the ideological wars of the 21st century. Paradoxically, government regulation or fear of foreign dominance could also cement the monopolies of existing platforms, even as it clips their ability to expand into adjacencies. As the power of these platforms is solidified, they become more powerful gatekeepers for any startups or new technologies, which may increase the risk of regulation even more. Thus, we will likely have to wait for new paradigms or phase shifts to emerge before we see dramatic, new innovations that match the accomplishments of the large Internet platforms. Fortunately, there is still plenty of “wet cement” out there in other spaces of technology, like autonomous driving, logistics networks, and traditional industries being disrupted by information-driven companies moving into their spaces – e.g., healthcare, energy, and finance. We are excited about the opportunities over the coming years across a number of emerging technologies, but large Internet platforms are less likely to drive the stock market performance for the next decade.

PS- we have many more thoughts on how best to regulate tech platforms, which we posted here back in March. The reality is regulation is coming, the problem remains that traditional, Industrial Age tactics, like breaking a company up, are fraught with risk in the Information Age. The range of outcomes is widening, and new tech leadership is likely to emerge.

Disclaimers:

The content of this newsletter is my personal opinion as of the date published and are subject to change without notice and may not reflect the opinion of NZS Capital, LLC (“NZS”). This newsletter is simply an informal gathering of topics I’ve recently read and thought about. It generally covers topics related to the digitization of the global economy, technology and innovation, macro and geopolitics, as well as scientific progress, especially in the fields of cosmology and the brain. I will frequently state things in the newsletter that contradict my own views in order to be provocative. I often I try to make jokes, and they aren’t very funny – sorry.

I may include links to third-party websites as a convenience, and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by NZS Capital, LLC (“NZS”). If you choose to visit the linked sites, you do so at your own risk, and you will be subject to such sites' terms of use and privacy policies, over which NZS Capital has no control. In no event will NZS be responsible for any information or content within the linked sites or your use of the linked sites.

Nothing in this newsletter should be construed as investment advice. The information contained herein is only as current as of the date indicated and may be superseded by subsequent market events or for other reasons. There is no guarantee that the information supplied is accurate, complete, or timely. Past performance is not a guarantee of future results.

Investing involves risk, including the possible loss of principal and fluctuation of value. Nothing contained in this newsletter is an offer to sell or solicit any investment services or securities. Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.